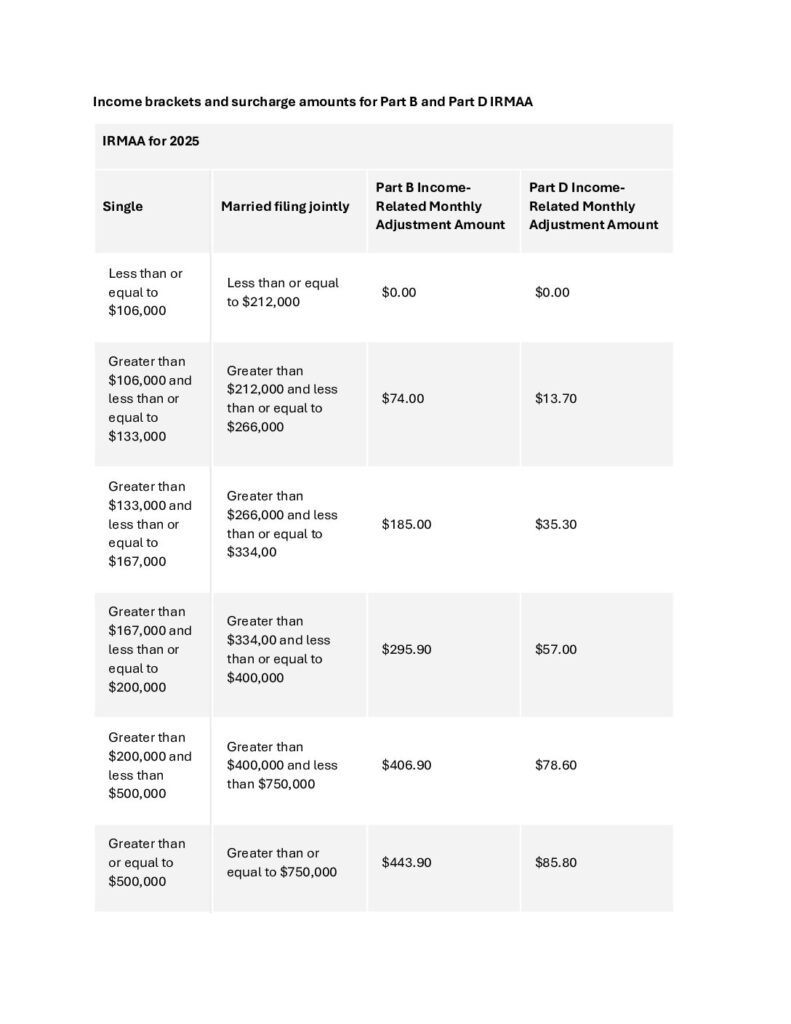

If you are wondering how to appeal higher Medicare premiums, you may qualify for income-related monthly adjustment amount (IRMAA). If you are part of the 7% of Medicare beneficiaries who pay more than the standard rate of $185.00 per month for Medicare Part B, there is a way to appeal this premium increase. Many people who enroll in Medicare thinking they will pay the standard rate often are billed for much more. This adjustment is called an income-related monthly adjustment amount or IRMAA.

While the standard monthly premium for Medicare Part B is $185.00 in 2025, some beneficiaries pay as much as $628.90.

If your income is different from what the Social Security used to determine the adjustment, For example you retired and your income has been reduced, there is a process for asking the agency to reconsider. You will need to use this form to request a reduction SSA-561-U2. Or you can now go online and complete the appeal, visit https://secure.ssa.gov/iApplNMD/start

What is IRMAA?

The annual income of older Americans could drop significantly from one year to the next for a variety of reasons. It might be retirement or the death of a spouse, perhaps, or the sale of a business. Yet it might take Medicare — which charges higher earners more for premiums — a couple years to adjust when income falls below the threshold. If you’re paying more than the standard amounts for Medicare Part B (outpatient services) and Part D (prescription drugs) through so-called income-related monthly adjustment amounts, or IRMAAs, the difference can reach into the hundreds of dollars per month. And, the surcharge is often based on your tax return from two years prior — which may not accurately reflect your current financial situation.

How is IRMAA Calculated?

Of Medicare’s 62 million beneficiaries, about 7% — 4.3 million people — pay those monthly surcharges, due to various legislative changes over the years that have required higher-earners to pay a greater share of the program’s costs. IRMAAs kick in if your modified adjusted gross income is more than $106,000 for Single filers; and for married couples filing joint tax returns, they start above $212,000.

The standard monthly premium for Part B this year is $185.00, which is what most Medicare beneficiaries pay. (Part A, which is for hospital coverage, typically comes with no premium.) The surcharge for higher earners is from $74.00 to $443.00, depending on income. That results in premiums ranging from $259.00 to $628.90

IRMAA Appeal Chart

IRMMA also will increase your Part D drug plan premium. For Part D, the surcharges range from $13.70 to $85.50. That’s in addition to any premium you pay for the Part D plan, whether through a standalone prescription drug plan or through an Advantage Plan, which typically includes Part D coverage.

As mentioned, the Social Security Administration relies on your most recently filed tax return — which often is from two years prior — when determining whether you’ll be charged the extra amounts. In other words, for 2020, that would have meant your 2018 tax return was used.

Appealing Your Part B and D Premium

The Social Security Administration (SSA) determines if you owe an IRMAA based on the income you reported on your IRS tax return two years prior, meaning two years before the year when you pay the IRMAA. For example, Social Security would use tax returns from 2019 to determine your IRMAA in 2021. If you are unsure why you are paying an IRMAA, you can call the Social Security hotline at 800-772-1213.

Requesting A New Initial Determination

If Social Security determines that you should pay an IRMAA, they will mail you a notice called an initial determination. This notice should include information on how to request a new initial determination. You can request that Social Security revisit its decision if you have experienced a life-changing event that caused an income decrease, or if you think the income information Social Security used to determine your IRMAA was incorrect or outdated.

Social Security Changes

Social Security considers any of the following situations to be life-changing events:

- The death of a spouse

- Marriage

- Divorce or annulment

- You or your spouse stopping work or reducing the number of hours you work

- Involuntary loss of income-producing property due to a natural disaster, disease, fraud, or other circumstances

- Loss of pension

- Receipt of settlement payment from a current or former employer due to the employer’s closure or bankruptcy

You can make the case that Social Security used outdated or incorrect information when calculating your IRMAA if, for example, you:

- Filed an amended tax return with the IRS

- Have a more recent tax return that shows you are receiving a lower income than previously reported

To request a new initial determination, submit a Medicare IRMAA Life-Changing Event form, go online at https://secure.ssa.gov/iApplNMD/start or schedule an appointment with Social Security. You will need to provide documentation of either your correct income or of the life-changing event that caused your income to decrease. The form SSA-44 has complete instructions on what documentation is required.

For more information or help making this appeal, contact Bob Garrison at 940-382-4700 for assistance.