It would not be wrong to say that people above 65 need long-term care at some point in their lives! But woefully, not all health insurance plans cover

Things You Should Know About Medicare If Relocating!!

Signed into law in 1965, Medicare is a federally funded insurance health program. The objective of the program is to provide low-cost, comprehensive

How to Pick an Unbiased Medicare Broker or Advisor!!

It is not easy to find a knowledgeable, unbiased, and trustworthy Medicare advisor when you are planning to enroll in a new Medicare program or want

Should I consider long-term care insurance? Or, is it just a waste of money?

Whether it is in the form of hospitalization, assisted living, or home healthcare, the elderly often need help in their twilight years. It might be

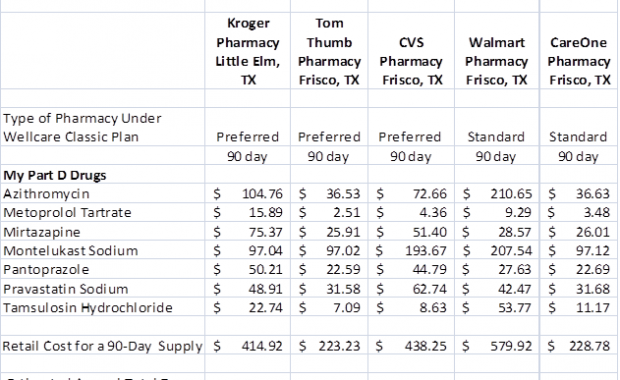

How to Save on Prescription Drugs!!

Selecting the correct Medicare Part D drug plan is important to make sure your medications are covered and the drugs are on the lowest tier. However,

Can My Parents Use My Health Insurance? Who Offers The Best Health Insurance For Parents/Retirees?

As you become an adult and your parents approach their 60s, it becomes your responsibility to take care of their health and wellbeing. Using the right

Not All Homeowners Insurance Policies are the Same!

Homeowner's insurance is a type of property insurance, which means that it affords financial compensation to owners for loss or damages to their

What are Medicare Insurance Plans and Their Types?

Medicare insurance plans are subsidized healthcare services provided by the federal government in the USA to its eligible citizens. As per the program

Key Factors to Consider While Choosing Senior Citizen Health Insurance Plans!!

Considering the rising medical cost, a good insurance plan is essential for every member of a family. And if that individual is your aging parent,